Table of Content

- How much is homeowners insurance on a $200,000 house?

- Most & least expensive zip codes for homeowners insurance in California

- Best home insurance companies

- Questions to Ask About Homeowners Insurance

- What Does a Home Insurance Adjuster Look For?

- How do I know how much homeowners insurance I need?

- Does homeowners insurance go down when mortgage is paid off?

The nationwide average annual cost for home insurance for common coverage levels, based on a rate analysis by Insurance.com are as follows. Having a dog is often seen as a higher risk for dog bites and insurance claims, which can lead to higher rates. Here are factors insurance companies typically use to determine a home insurance premium. Most carriers offer discounts if you buy more than one policy or if you safeguard your home with a burglar alarm or sprinkler system.

Homeowner's insurance pays for losses and damage to your property if something unexpected happens, like a fire or burglary. When you have a mortgage, your lender wants to make sure your property is protected by insurance. That's why lenders generally require proof that you have homeowner's insurance. Mortgage insurance lowers the risk to the lender of making a loan to you, so you can qualify for a loan that you might not otherwise be able to get. Typically, borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance. These types of coverage are often also set in proportion to your dwelling coverage limit.

How much is homeowners insurance on a $200,000 house?

To determine how much personal property coverage you need, you should make an inventory of your personal belongings and estimate what it would cost to replace them. This number is what you should aim for as a personal property coverage limit. In some cases, your insurer will automatically set your personal property coverage at 50% of your dwelling coverage. Based on Insurance.com’s rate analysis, on average the home insurance cost in Texas is $4,142.

Additionally, consider whether you have any special features or amenities that could increase your flood risk, such as a pool or basement. Lastly, review your policy’s exclusions and any other coverage that may be important to you. Broad form coverage, like the basic form HO-1, only covers named perils.

Most & least expensive zip codes for homeowners insurance in California

Homeowners can ask friends and family for recommendations, shop around online, make phone calls, ask for quotes, and check the business records of companies they’re considering. The deductible on a policy is one of the few things that it is really possible to control when choosing a homeowners insurance policy. In other words, this is an opportunity to hedge saving money against the likelihood of making a claim in a given year. Aside from your home’s value, location is one of the most important factors to impact home insurance coverage and costs. This is because your particular location has a lot to do with how insurance companies calculate potential risks.

We looked at home insurance estimates by ZIP code across the country to find the highest average rate for home insurance in each state as well as the least expensive average rate for home insurance. If you refinance your current loan's interest rate or refinance into a different loan type, you may be able to cancel your mortgage insurance. Dwelling coverage refers to the coverage for your home’s physical structure. In general, you should aim for your dwelling coverage to equal the cost to replace your home if a disaster destroys it. For example, if your home would cost approximately $200,000 to rebuild from the ground up, you should invest in the same amount of dwelling coverage. How much coverage you’ll need depends on your unique circumstances, including how much your home is worth, what it would cost to rebuild and how much money you have on hand.

Best home insurance companies

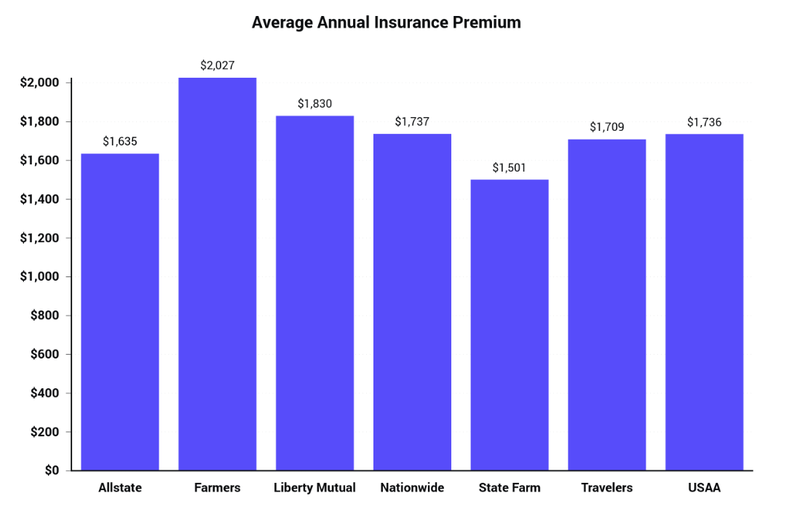

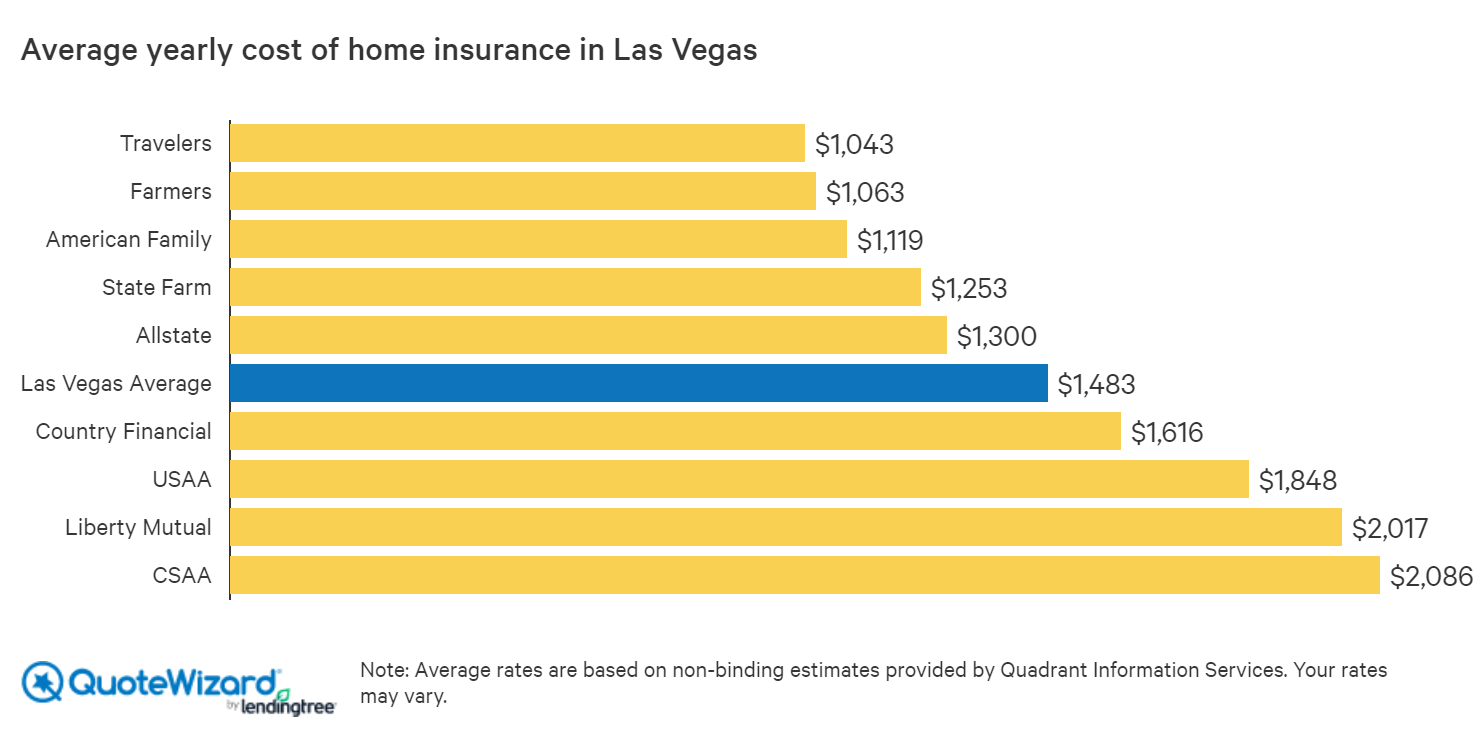

Here are the top-rated home insurance companies for 2022, based on Insurance.com’s analysis of average rates, J.D. What you pay for coverage depends on many factors, but one of the major variables is where you live. Our home insurance calculator lets you get a home insurance estimate for your ZIP code at various coverage levels.

In the U.S., home insurance costs an average of $1,383 per year for a policy with $250,000 in dwelling coverage. Keep in mind that your premium will vary based on where you live, your prior claims history, your home’s features and more. While price is important, seeking out the cheapest home insurance you can find might not be the best shopping strategy. Staying on top of home insurance rates is an ongoing task that involves taking stock of any risk changes each year. The states with the most expensive average annual home insurance premiums are Oklahoma, Nebraska, Kansas, Arkansas and South Dakota.

Paid either monthly or in a lump sum upfront, typically, you can expect PMI to cost between 0.58% to 1.86% of the loan amount according to mortgage insurance data from the Urban Institute. In dollars, Freddie Mac estimates this to look like $30 to $70 per $100,000 added to a monthly mortgage payment. You can pay off your homeowners premium in several ways, though your mortgage company may require you to pay it off according to their terms and conditions. Lenders usually will want you to contribute monthly into your home insurance escrow which will then pay the premium upon renewal of the policy's term. In addition to your premium, you usually have to pay other costs for your health care, including a deductible, copayments, and coinsurance.

The cost of flood insurance depends on a variety of factors, including the location of your home and business, the level of flooding that is expected in your area, and the coverage you choose. However, it is focused on personal property, and this policy does not cover the structure of the building. Standard homeowners insurance does not cover damage from floods that are outside the home.

Just be sure to talk to a licensed insurance agent before making any changes to your home insurance. Home insurance is a many-faceted product and while $250,000 in dwelling coverage may be sufficient for some homeowners, it may not be enough for others. Your home’s characteristics, your location and local labor costs are among some of the factors that may determine how much you pay for coverage . The average annual home insurance premium for a home with a dwelling coverage amount of $250,000.

The cost of homeowners insurance can be remarkably flexible based on what is being insured, and there are several ways to lower homeowners insurance rates by making a few smart decisions. First, if a homeowner has a mortgage, lenders will most likely require them to carry homeowners insurance. From the borrower’s end, that’s one less bill to pay, but it also means that it’s easy to forget to review coverage periodically, which is important.

No comments:

Post a Comment