Table of Content

Medical payments coverage pays for injuries to guests in your home, regardless of who is at fault. Medical payments differs from liability insurance in significant ways, primarily in that it is for minor incidents and comes in very low limits of $1,000 or $5,000. Insurance.com is dedicated to informing, educating, and empowering you to make confident insurance decisions. Our content is carefully reviewed by insurance experts, and we rely on a data-driven approach to create unbiased, accurate insurance recommendations. Insurance.com maintains editorial integrity through strict independence from insurance companies.

As a former claims handler and fraud investigator, he’s seen a lot, and enjoys helping others navigate the complexities and opaqueness of insurance. In Criminal Justice from Kutztown University and an M.F.A. in Creative Writing from the University of California Riverside, Palm Desert. But even if you’ve already paid off your home, home insurance is a good idea.

Deductible amount

Location is one of the biggest factors in your home insurance rates. Learning how to calculate your home replacement cost or value is important because the amount helps you determine how much dwelling coverage to buy. You also choose a home insurance deductible amount, which applies to claims for damage to your home or belongings.

Power customer satisfaction score, financial strength, available digital tools and more. If your home insurance payment is made through your mortgage company, it’s generally paid through an escrow account. This is a separate account where your mortgage lender collects money for your homeowners insurance and makes the payments on your behalf.

What is Guaranteed Replacement Cost Homeowners Insurance?

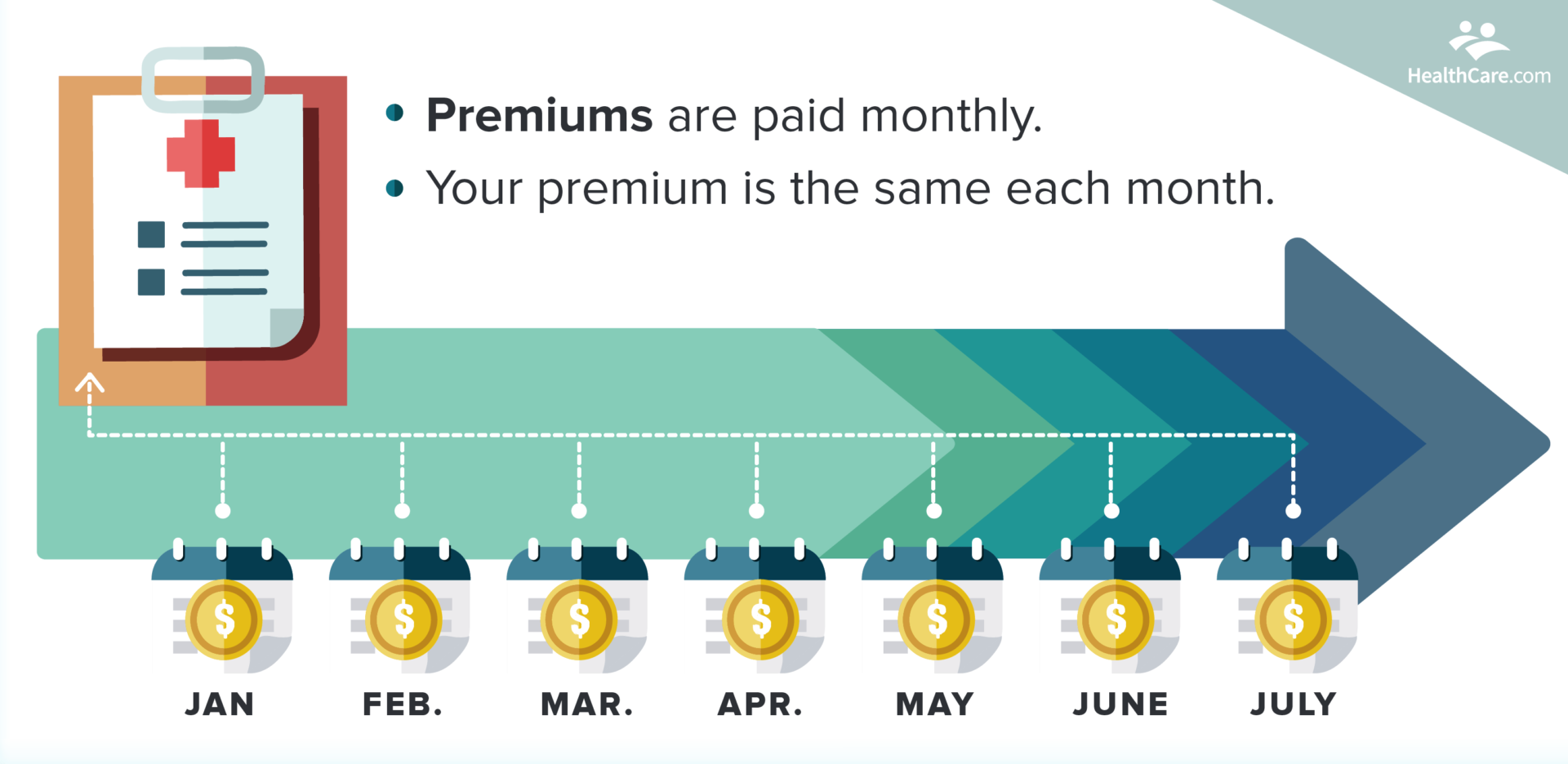

A home equity line of credit is a great safeguard, but when the home itself is lost, that’s no longer an option. Homeowners insurance is a fundamental, unambiguous need for homeowners. Homeowners may want to consider one of the best homeowners insurance companies like Lemonade or Allstate when shopping for a homeowners policy. Most mortgages are set up with an escrow account, which means that the mortgage company collects a portion of your home insurance premiums in your monthly payment. These amounts will be saved in your escrow account and the mortgage company will then pay your home insurance and property taxes when they come due.

Remember you can lower your rate by making sure you receive all the home insurance discounts for which you qualify. For example, buying your home insurance from the same company that covers your cars, called bundling, can save you an average of 19%. Liability insurance pays out when you or a family member are legally responsible for others’ injuries or property damage. Personal liability also covers legal fees if you are sued, as well as any resulting judgments from a lawsuit, up to your policy limits.

Dwelling Coverage

The lower your LTV, the higher the risk for the lender, which is why the cost of PMI often increases as your LTV decreases. The higher your score, the less risk you represent to lenders, so it may be possible to qualify for lower PMI with good credit. One way to avoid paying PMI is to make a down payment that is equal to at least one-fifth of the purchase price of the home; in mortgage-speak, the mortgage's loan-to-value ratio is 80%. If your new home costs $180,000, for example, you would need to put down at least $36,000 to avoid paying PMI. You can lower your rates by adding storm shutters, updating your roof, and other risk-mitigating changes.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Here are annual and monthly average home insurance costs by state. The Kansas Insurance Department estimated losses of $220,840,165 in 2022 from windstorms, tornados and hail, which contributes to Kansas’ high homeowners insurance rates. For more information on how home insurance rates are determined, review some of the main factors affecting your home insurance rate.

Homeowners with lower credit scores may have to pay more simply because the insurance company regards them as a bigger risk; while this is not necessarily true, it’s a fact of the insurance market. Basic homeowners insurance policies do not cover the equipment and supplies kept in a home for a home-based business. That equipment will need to be protected, however, the same way the rest of the home is protected.

A higher dwelling coverage typically results in higher annual premium, but it’s still possible to find competitive premiums from different home insurance carriers. The proprietary rate data below highlights how your dwelling coverage limit could affect your average homeowners premium. Nationally, we found that Progressive has the cheapest home insurance premiums at $1,236 per year for $300,000 in dwelling coverage. But your rates will vary depending on the cost to rebuild your home, where you live, how much coverage you choose and other factors.

Coastal areas are more exposed to strong, damaging winds, and salt spray can cause steel and wood to age faster and fail sooner, so those risks also produce higher rates. All of these rates use a $1,000 deductible and $300,000 in liability. Getting home insurance discounts could be the easiest way to save money. Bankrate follows a stricteditorial policy, so you can trust that we’re putting your interests first. All of our content is authored byhighly qualified professionalsand edited bysubject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Before choosing a system, homeowners will want to check with their insurer to see what their restrictions are about what kinds of systems earn the discounts. Some companies require fully monitored security systems, while others simply require a Wi-Fi system with self-monitoring. The savings on the insurance premium can significantly offset or even cover the cost of the security system, so there are two benefits for one cost.

Depending on your dwelling coverage limit, you may need to have a higher deductible. Geographic location typically impacts your insurance rates because every area of the country has a different risk level for potential damages. Some areas may have a higher risk of wind damage, for example, while other areas of the country often sustain damage from fires. NerdWallet strives to keep its information accurate and up to date.

No comments:

Post a Comment