Table of Content

For instance, a homeowner who has filed multiple theft claims may live in a high crime area or fail to employ security measures, increasing the risk of similar future claims. In another case, numerous fire claims may occur because the property is located in an area prone to brush fires. Hence, the presence of past fire claims indicates a higher risk of future liabilities. Finally, based on the same line of reasoning, past weather claims may show that the property has little natural protection from severe storms and may suffer damage by subsequent extreme weather events. Borrowers who can make a big down payment will save a lot over the life of their mortgage loan. But a smaller down payment allows many first-time home buyers to get on the housing ladder sooner.

For example, if you live in an area prone to natural disasters like hurricanes or wildfires, you can expect your premiums to be higher. You may see premium increases at your policy renewal even when you haven’t changed your coverage. Insurance companies often adjust your coverage limits to keep pace with inflation, which helps to ensure your home is still properly covered when things get more expensive. Your company may also have filed a rate change with your state’s Department of Insurance, which could then affect the price you pay for coverage. The age of your home is also a factor that home insurance companies consider when determining your premium. Older homes might be more expensive to build back after a loss, especially to bring up to code to modern safety and building codes.

Why did my home insurance go up?

Its average rates are an astounding 203% lower than the national average. States with frequent hurricanes, hailstorms, tornadoes and earthquakes tend to have higher home insurance rates. To get the best rates for your situation, shop around with at least three insurance companies. By comparing rates from multiple insurers, you can make sure you’re getting the best possible coverage at the lowest price. It’s likely no surprise that many of the most expensive ZIP codes for home insurance are in states that experience lots of severe weather.

Hurricane Iniki, which hit in 1992 did so much damage that the majority of insurers excluded hurricane damage from their coverage. Homeowners in Hawaii now have to purchase a separate hurricane damage policy,” says Michael Barry, spokesman for the Insurance Information Institute. Insurance.com’s ranking provides an in-depth look at the best home insurance companies in 2022, based on a number of factors. Insurance.com ranked the major insurance companies for average price, J.D. With every type of insurance coverage, it's true that the cheapest policy isn't always the wisest choice. You want an insurance company that is financially healthy and that has a good reputation for service.

How much is homeowners insurance in California?

Some important questions to remember to ask include the following. Insurance companies base their rates on a multitude of statistics. One they pay close attention to is the number of claims in your area. Even if you have never filed a claim, the claims of your neighbors could result in a broad increase for the whole area. For example, a rash of burglaries in your neighborhood could result in higher insurance bills. Similarly, if you live in an area with a high crime rate or an elevated risk of burglary or vandalism, you’ll likely end up paying more for home insurance.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. The best way to find cheap home insurance where you live is to compare home insurance quotes from multiple insurers.

How much is homeowners insurance on a $200,000 house?

You should also consider streamlining the heating system, electrical system, and plumbing in order to lower the possibility of fire and water damage. At $400,000 in coverage the highest annual average rate is $6,387 in Oklahoma and the lowest annual average rate is $749 in Hawaii. Oklahoma has the highest home insurance rates in the country at $5,317 a year. Hawaii, on the other end of the spectrum, is the cheapest state for home insurance at only $582 a year. The offers that appear on this site are from companies that compensate us.

A more expensive home insurance policy will mean that your mortgage company needs to collect more money from you monthly, so your mortgage payment could be higher. However, keep in mind that the portion of your monthly mortgage payment that is earmarked for home insurance doesn't affect the principal or interest on your mortgage loan. A treehouse, trampoline, and swing set can save money on amusement park visits, but they can also increase insurance rates. Unless the yard is fully fenced—and sometimes even then—those structures can be classified as “attractive nuisances.” Every child who passes by will be drawn to the structures, and that makes them a risk. A passing child may be tempted to sneak over to try out the neighbor’s trampoline or water slide in an unguarded moment.

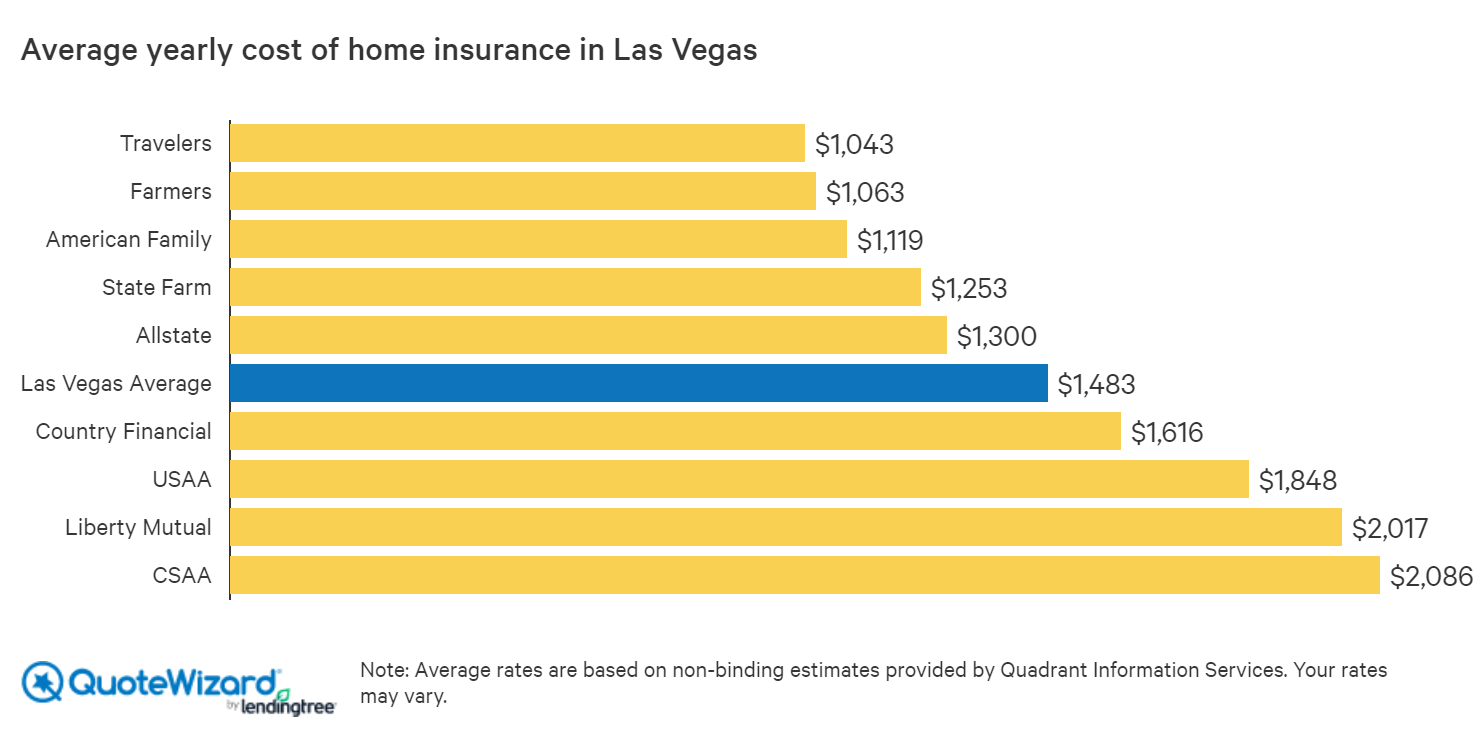

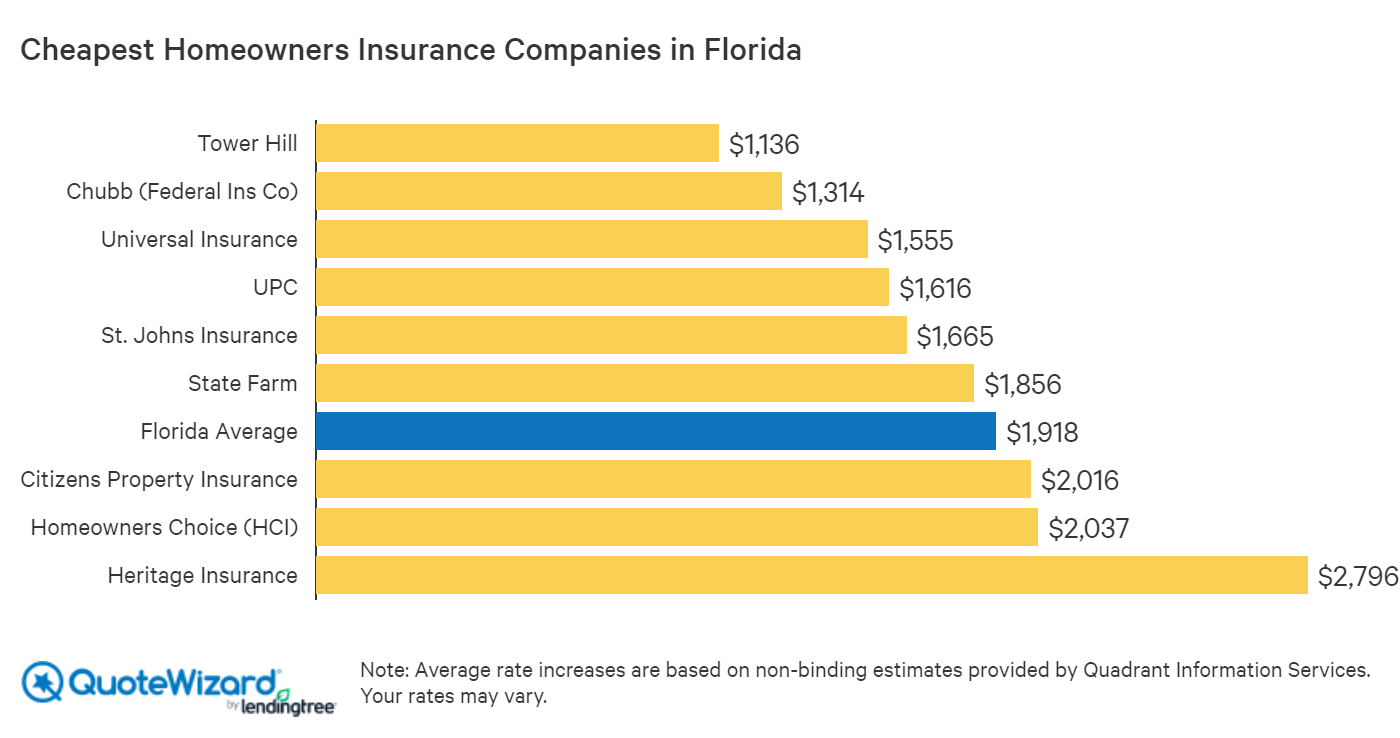

Here are average annual home insurance rates for 10 of the largest companies. Note that some may not offer homeowners insurance in your state. Using our home insurance calculator below, you can compare average home insurance rates by ZIP code for 10 different coverage levels.

Most insurers will offer the option of purchasing a business endorsement for the policy, which would add coverage to the homeowners policy to protect their business equipment. Another option is to purchase a completely separate business policy. Either will provide good protection, but both will increase the overall insurance cost. Depending on the type of business, it may be possible for homeowners to claim the cost of the insurance on their taxes if the space is defined as a home office. Homeowners can consult a tax professional or financial adviser to determine whether they are eligible for any tax deductions. Older homes cost more to repair than newly built ones, and are likely to require more frequent repairs, which can raise the cost of homeowners insurance.

The location of a home can make a significant difference in policy cost. Finally, if the home is located in a state that is far from where building materials are produced, those materials will cost more for a repair or rebuild. Insurers know that and cover their own increased costs with higher rates. Pools, hot tubs, or outdoor spas are wonderful amenities, but they do increase homeowners insurance premiums.

You'll see the average rate, as well as the highest and lowest fielded from major carriers. Local security alarms — the kind that ring only at your residence — may scare away burglars and vandals, leading to a decreased risk of severe theft. Monitored alarms, which ring at your residence and also alert authorities, often come with a larger discount. This is because by automatically altering the proper authorities, these alarms can lessen potential claim damage by getting emergency crews to your home as quickly as possible. Inflation is causing the cost of home repairs to increase, which means home insurance rates are increasing. This helps companies ensure they have enough money in their claims reserves to pay out higher losses.

Homeowners insurance often gives policyholders a discount for having a security system installed. The exact discount will vary between insurers, as will the specific requirements, so it’s advisable for homeowners to ask for details before choosing a security system if budget is a concern. Homeowners won’t always be aware of the available discounts, which could be offered for first-time home buyers, homeowners who choose paperless billing, and newly constructed homes. The insurance agent will be able to advise the homeowner on which discounts they may be eligible for.

No comments:

Post a Comment